Section 20 CSR 400-5400 - Life Insurance and Annuities Replacement. Both offer tax-deferred growth and similar to life insurance policies annuity contracts may offer death benefits to beneficiaries.

Life insurance pays an individuals loved ones after they die.

. The replacing insurance company must require from the producer a list of the applicants life insurance or annuity contracts to be replaced and a copy of the replacement notice provided to the applicant and send each existing insurance company a written communication advising of the proposed replacement. Replacement of existing life insurance and annuities. But thats where the similarities end.

Lapsed forfeited surrendered terminated paid up insurance term insurance reissued with reduction fo cash value used in a financial purchase do not apply to grou plife insurance. Payments which are generally made on a monthly basis are usually arranged to continue for as long as you live or for a stated period of time. Replacing a life insurance policy isnt as easy as changing your car insurance.

2 To protect the interests of life insurance and annuity purchasers by establishing minimum standards of conduct to be observed in replacement or financed purchase transactions. Replacement of existing life insurance and annuities. While annuities are designed to provide money for you to live on the goal of life insurance is designed to provide for others when you pass away.

I Assure that purchasers receive information with which a decision can be made. Coverage for newborns under accident and health plan MUST include coverage for. Life insurance and annuity replacement can be BEST described as Exchanging an existing policy for a new policy When is a Group Health policy required to provide coverage for a newborn child.

A Assure that purchasers receive information with which a decision can be made in his or her own best interest. 2 To protect the interests of life insurance and annuity purchasers by establishing minimum standards of conduct to be observed in replacement or financed purchase transactions. Annuities take payments upfront then dole out.

Although a replacement could. Transaction in which new life insurance or annuity is purchased out. The existing life insurance or annuities will be any of the following.

Annuities and life insurance are both contracts between insurers and policyholders. Life insurance and annuity replacement can be BEST described as exchanging an existing policy for a new policy The Rules Governing Life Insurance and Annuity Replacements do NOT apply to. 2 To protect the interests of life insurance and annuity purchasers by establishing minimum standards of conduct to be observed in replacement or financed purchase transactions.

Although life insurance policies do not provide lifetime. 2 To protect the interests of life insurance and annuity purchasers by establishing minimum standards of conduct to be observed in replacement or financed purchase transactions which will. Payments may begin at once or at some future date.

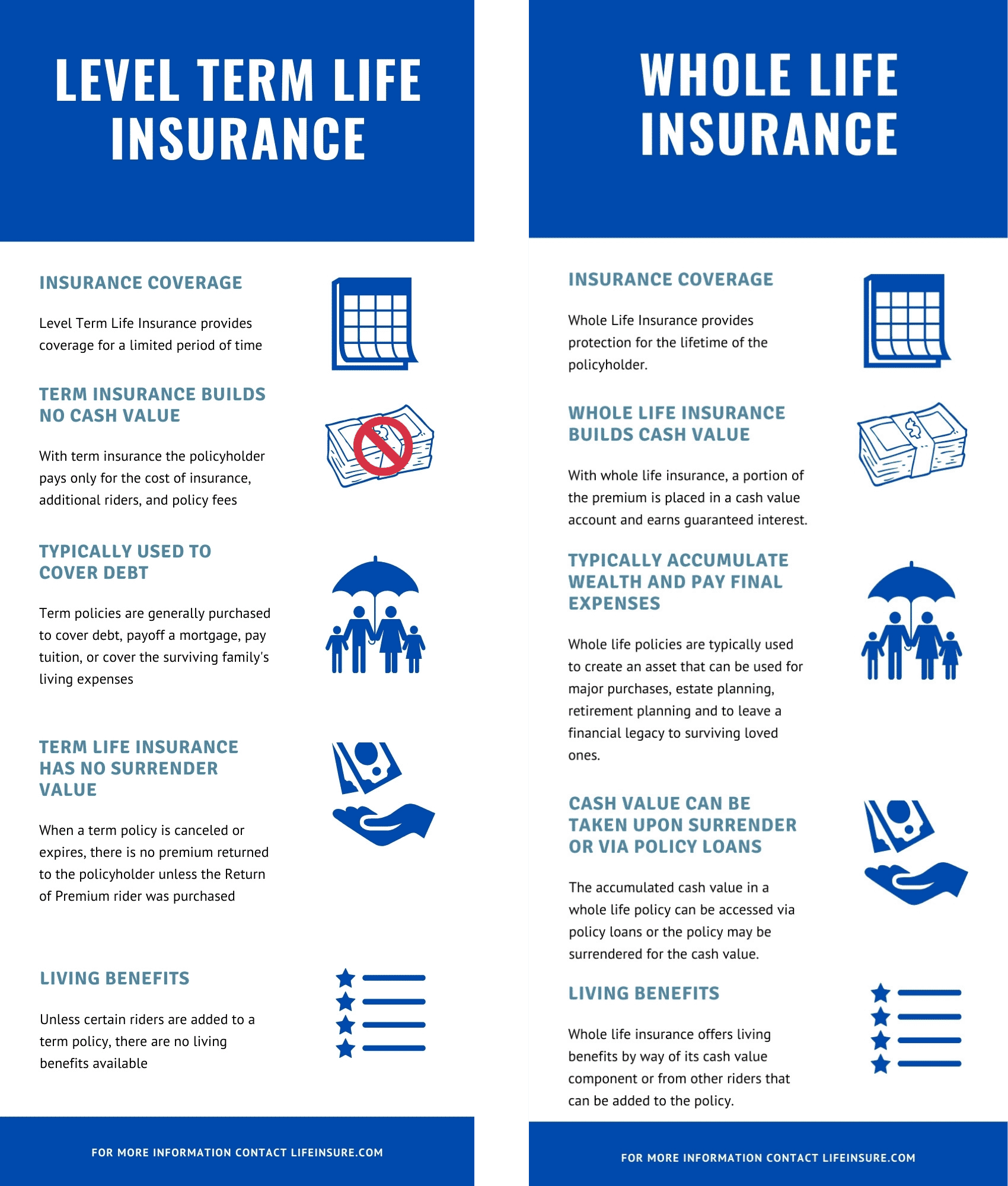

Annuities come with tax implications and lower rates of return than other investments. Life insurance and annuities both allow individuals to invest on a tax-deferred basis. Annuities are sometimes described as reverse life insurance becauseat least on the surfacethey are designed to protect against the opposite risk.

A Ensure that purchasers receive information with which a. Life Insurance and annuity replacement can be best described as Any transaction in which a new life insurance policy or annuity is bought to replace an existing one is referred to as a replacement. An annuity is a contract written by a life insurance company to provide continuing income typically for retirement.

Life insurance beneficiaries can choose an annuity to receive multiple payments over a set period often 10 to 20 years or their lifetime instead of a lump sum. A life insurance applicant in Ohio may backdate the application for up to ___ months. Factors involved can negatively affect a policyholders coverage and future costs.

Most people should choose a lump-sum payout which is tax-free. December 30 2021. Life insurance and annuities are two types of long-term investments for financial planning that people often get mixed up with each other.

A Assure that purchasers receive information with which a decision can. An example of endodontic treatment is a. 1634 Existing life insurance or annuity means any life insurance or annuity in force includ-ing life insurance under a binding or conditional receipt or a life insurance policy or annuity that is within an unconditional refund period.

1 To regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. It will assure that purchasers receive information with which a decision can be made in his or her own best interest. Respect to the replacement of existing life insurance and annuities.

1635 Replacing insur er means the insurance company that issues or proposes to issue a new policy or contract which is a replacement of existing. B To protect the interests of life insurance and annuity purchasers by establishing minimum standards of conduct to be observed in replacement or financed purchase transactions. Producers with respect to the replacement of existing life insurance and annuities and to protect the interests of life insurance and annuity purchasers by establishing minimum standards of conduct to be observed in replacement or financed purchase transactions.

Interestingly though the two products also have many similarities and can be used symbiotically as part of an estate or retirement plan. A common exclusion or limitation on dental policy is. This rule regulates the activities of insurers agents and brokers with respect to the replacement of existing life insurance and annuities and protects the interests of life insurance and annuity purchasers by establishing minimum standards of conduct to be observed in replacement.

Obtain a list of all life insurance policies that will be replaced.

Annuity Vs Life Insurance Similar Contracts Different Goals

Life Insurance Vs Annuity How To Choose What S Right For You

0 Comments